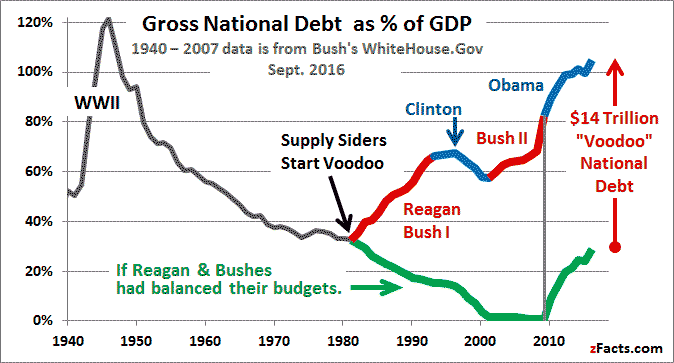

We’re still great, but here’s how national-debt policy was captured by Wall Street and went crazy. You can see exactly when it happened in this graph. You can even see the first President Bush predict it in the video clip below. And then take it back when he gets a new boss. Now Trump is under the Voodoo spell, and this time the country really is losing its greatness.

World War II was looming, and the country was flat broke. But Uncle Sam was popular, the country patriotic, and all were happy to lend him money. Compared to the size of the economy back then, the debt soon outstripped even today’s debt, and we won the war. Then, without any to-do, we almost paid it off, until …

Something weird happened. When Ronald Reagan became president. He rode to office on complaints of an “out-of-control debt” that was as big as “a stack of $1000 bills 67 miles high.” And in eight years in office he added another 125 miles to that stack.

| Debt: Total owed from past and present borrowing. Deficit: This year’s borrowing. |

As the graph shows, the debt was actually at its lowest point in 50 years compared to the US economy, but he grew the debt much faster than he grew the economy. That’s why the graph shoots up when he takes office. No one had done that since Word War II, and Reagan had promised to balance the budget. That’s weird.

But one guy saw it coming and said so loud and clear. And that same dude, a first-class Republican, is seeing the same thing all over again and says he’s voting for Hillary Clinton (09/19/16). His name is George H. W. Bush, the 41st president of the United States.

He called Reagan’s plan Voodoo economics, and when it came to the debt, that Voodoo made a zombie out of Reagan and generations of Republicans. Unfortunately Bush lost the primary to Reagan, and Reagan made him vice president. So not long after he called Voodoo on Reagan, he had to deny he ever said it. It’s well worth 22 seconds of your time to watch this:

What is Voodoo Economics?

Invented at a restaurant just off Wall Street by Wall Street journalists (and a kooky economist), its official name is “supply-side” economics. Don’t be fooled, in 40 years this has not become part of real economics. That’s because it central tenet is this:

“You cut taxes, and the tax revenues increase.” —Voodoo Economics

You gotta admit that sounds pretty weird. And you also have to admit that if Reagan believed that, he surely would have cut taxes. Which he did. And if it turned out to be crazy, then tax revenues would actually fall (Duh), the government would be short of money, would borrow like crazy and the debt would go up. Which it did.

But come on. Nobody really believes such nonsense, least of all our presidents. Well, maybe you should watch this eight-second video from 2006.

Yes, that’s George Bush II. By 2006 he should have known better. One month after taking office in 2001 with a plan to cut taxes, he said, he would “retire nearly $1 trillion in debt over the next four years. … the largest debt reduction ever achieved by any nation at any time.” Instead the debt went up by $2 trillion. But that didn’t break the Voodoo spell on him.

The same thing happened to him as to Ronald Reagan. He cut taxes, believed tax revenues would increase, but surprise — tax revenues went down. So the government had to borrow more. And the Debt, which had been going down, suddenly shot up. Once again it grew even faster than the economy and that’s why you see the graph going up in his first budget year.

Fool me once, shame on you. Fool me twice shame on me. Should we go for three times? You would think that after 20 years of Voodoo experiments turning out just like any sane person would expect, that at least the best and brightest Republicans would catch on. So here we are in 2015. Trust me again for 14 seconds and listen to Fiorina and Rubio:

As Carly says, this may seem crazy to you. But here are two of the brightest contenders in the 2016 Republican primaries repeating the same old Voodoo. When it comes to the debt, the GOP is the party of zombies.

Deja vu all over again — the Donald

Here’s what G. H. W. Bush saw back in 1980: “A big difference that the governor [Reagan] and I have regards his tax cut. He feels that

- you can cut taxes by $70 billion the first year and still

- balance the budget and

- increase defense spending.”

Trump’s September-2016 economic plan would:

- Cut taxes $440 billion per year

- balance the budget and

- increase defense spending.

These are not the only echos of the past. Reagan grew all sections of the military just as Trump promises, but his signature military boondoggle was his “Star Wars” program to “develop a sophisticated anti-ballistic missile system.” Trump proposes his own Star Wars to “develop a state of the art missile defense system” against N. Korea and Iran. (Sept 7 speech)

There is also much talk of the tax cuts boosting growth, just like under Reagan and the Bushes. Tax-cuts do create growth but that requires boosting the debt because they DO NOT pay for themselves. As explained below this is the heart of the Voodoo fallacy.

The real point here is that as of Sept 2016, Trump sounds just like Reagan and the Bushes. Prior to this, he sounded like Trump — crazy, but definitely not into the Republican Voodoo.

Has Trump fallen under the voodoo spell?

In Nov 1999 he proposed a 14% tax on family trusts worth more than $1 million, saying this would raise $5.7 trillion and wipe out the debt in one fell swoop. And he proposed to tax the “one percent of Americans, who control 90 percent of the wealth” and said “The other 99 percent of the people would get deep reductions in their federal income taxes.” Sounds like he was the founder of Occupy Wall Street.

In Aug 2015, sounding more like Bernie Sanders he said, “The middle class built this country, not the hedge fund guys,” and proposed a tax hike for the rich and a cut for the middle class. Again, this has nothing to do with supply-side economics.

On Mar 31, 2016 he told the Washington Post, “We’ve got to get rid of the $19 trillion in debt. I think I could do it … over a period of eight years. … Our deals are so bad. With China, $505 billion this year in trade. We’re losing with everybody.” Of course the government didn’t spend that $505 billion (which includes all trade) so it has nothing to do with the national debt. No one bought this 100%-pure Trumpian nonsense.

By August Ryan’s campaign spokesman said it (the September plan) “has many similarities to the job-creating plan at the heart of House Republicans’ agenda.” That plan, as described above, was back to Republican supply-side economics.

According to the conservative Tax Foundation, everyone would get at a 0.8% increase in income but the top 1 percent would get at least 10.2% increase. And when you apply 0.8% to $40,000 and 10.2% to $40,000,000 you find the poor family gets a $320 increase and the rich family a $4,080,000 increase (Trump would get even more). That’s very much like Reagan’s tax cuts, and it’s in keeping with Voodoo economic “theory.”

Trump has been captured by the supply-siders, just as Reagan was. Reagan never understood their “theory,” but he loved their rosy predictions that cutting taxes for the rich would generate so much economic growth that everyone, especially the rich, would pay more taxes and balance his budget. Here we go again.

The green line: If the Republicans had balanced their budgets

The green line on the graph shows what would have happened if the supply-side presidents, Reagan and the Bushes, had balanced their budgets, and Bill Clinton and Obama had taxed and spent exactly as they actually did.

Instead of Reagan adding 125 miles of thousand-dollar bills to the debt, I assume he adds nothing at all. Because the economy kept growing, the size of the debt relative to the economy would have decreased, as shown by the green line. And this would have continued under Bush for the same reasons.

Then I assume Bill Clinton taxed and spent the same. But with a smaller debt there would have been less interest to pay on the debt so he would have paid off more of the debt, just like happens when a home mortgage is half paid off. This would have brought the debt down to essentially zero, which is where it was heading before the Voodoo started.

Finally, I assume G. W. Bush also balanced his budget and kept the debt near zero. But again, I assume that Obama taxed and spent just the same as he did. (Shortly, I’ll explain why that was needed.) The result is that the National Debt would be $14 trillion lower if Reagan and the Bushes had done what they said they would and balanced their budgets.

The national debt in perspective

Consider what it means when the graph says 100%. It means the national debt equals one year of Gross Domestic (National) Product (GDP). So if we used the full value of what the US produces for one year just to pay off that debt, that would just do it. And 50% means, the debt would be paid off in six months of using the full output.

That sounds outlandishly huge, but consider a family making $100,000 a year that buys a $250,000 house with 20% down and takes a $200,000 mortgage. No one considers this unusual or risky. But that family would be off the top of the graph at 200%. It would take all they made for two years to pay off their debt. And the US has a slight advantage over most families. It can print money. So there is zero chance of default.

And only about 1/3 of the debt is owed to foreigners. Another 40% is owed to Americans, for example pension plans own quite a bit of it. And the rest is owed by the US government’s “General Fund” to other Government Trust Funds, like the Social Security Trust Fund and the military’s pension fund.

Stop with the doom and gloom. If, as conservatives fear, the Chinese tried to bankrupt us by cashing in all their treasury bonds. We could simply print the money and pay them. Not a problem. And no, the high debt is not harming our credit. If you have bad credit, people will only loan you money at a high interest rate. Everyone in the world is willing to loan Uncle Sam money at almost zero interest. He’s got absolutely the best credit rating in the world.

The Secret of Tax Cuts and Economic Growth

The supply-siders keep saying tax cuts will cause so much economic growth that it will reduce the debt. And it keeps not working. But they’re half right. It has long been know that tax cuts can stimulate the economy, especially in a recession. Here’s how that works.

Say the government reduces taxes by $1 billion per year, but does not fire anyone and does not stop buying anything. Then no one that sells to or works for the government loses their job. But taxpayers have an extra $1 billion in their pockets and they spend most of it. Businesses sell more and so they hire more workers.

But how can the government keep spending without that $1 billion in taxes? Simple, they borrow the $1 billion. So yes, tax cuts cause growth and INCREASE the debt, if the government keeps spending. And that’s what’s been happening.

So a tax cut that creates debt is a good thing in a recession. In fact you could cut everyone’s taxes in half and you might have hired and extra 6% and ended the Great Recession very quickly. But with 6% more workers and everyone paying half as much tax, no, you will not increase tax revenue. You will increase the debt.

But that’s a good tradeoff. Unemployment is quite wasteful for society and costly in many ways for the unemployed. The trick is to pay down the debt once the economy is humming again. The graph shows Bill Clinton did that and Obama is headed that direction, but Reagan and the Bushes didn’t. That’s because they believed in the Voodoo — cut taxes and tax revenues will increase. No need to worry about the debt. So they didn’t.

Theme sponsored by: Adderall website where you can buy Adderall online buyadderall.com and learn about how Adderall and how modafinil works buymodafinilonline365.com. You can learn about how to buy modafinil online from USA and how modafinil works. Also find out how Modafinil works when you are planning on buying Modafinil online.