May 21, 2012. Market “sentiment improved after G8 leaders … stressed over the weekend that their “imperative is to promote growth and jobs.” —Reuters. This is a reversal of their previous austerity/budget-cutting position. The result? “Nasdaq’s best 1-day percentage gain since December 2011.” The market always favors stimulus over austerity — because it works.

How We Get Out of the Great Depression II

By Steven Stoft, March 2, 2009

Here we go again: Hoover got us in, and WWII got us out. Bush got us in, and to his credit, started trying to get us out. Though, mostly he threw money at bankers.

Of course after the war, we had to pay off a huge national debt, but during that time, from 1946 to 1980, the economy was mainly quite prosperous. We hit a bad recession when Reagan took office, and his early deficit spending made sense (though he didn’t know it). But then he continued to drive up the debt through the boom years that followed. See a graph of just how disastrous that was.

We are now headed into the worst slump since 1938, and you better hope Obama can fix it because that was not a pretty time. Unfortunately, as in the Great Depression, the extreme conservatives would rather trash the country than have our government succeed. They are much worse than Bush.

The main thing to remember is that, with consumer spending going down, business is going to lay people off—not hire them. You can’t blame business for this. It’s just a vicious cycle that the economy gets into. And you can’t blame consumers for not spending in bad times. The only way out of this, if we don’t want to wait 10 years, is for the government to spend, pay unemployment insurance, or give tax breaks to people who will spend (not the rich). Of course there’s also the problem of the banks. Obama should stop saving the bankers, and just take over the bad banks. Once they’re working they can be sold back to the private sector.

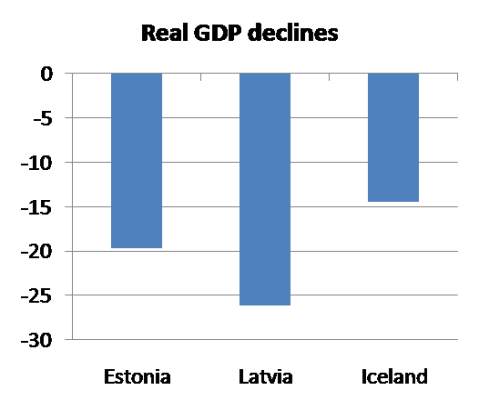

What Tea-Party Policies Did to Ireland

This is what we could have faced had we not run up a deficit  .

.

China Did it Right

May 31, 2010. Buoyed by massive government spending programs and a flood of easy credit from state-controlled banks last year, China’s economy recovered rapidly from the global financial crisis. Buoyed by an expected growth rate of around 10 percent this year, China is poised to overtake Japan as the world’s second-largest economy, after the United States, sometime this year. full story

Why Borrow and Spend for Economic Stimulus?

July 11, 2009. Money flows in circles: you get paid; you spend it, and the store pays someone else, who spends at another store. But what if everyone spent 90% and saved 10% in the bank? The circular flow of money would dwindle away to nothing, all the money would end up in the bank, the stores would shut and we’d all be out of work.

We do save some, so why doesn’t this happen? Because other people and businesses borrow and spend what the borrow. That’s good. It keeps things going.

But in a recession, like now, businesses don’t want to borrow and invest. and right now people are saving more than they have in years. So the circle of money is dwindling and people are losing their jobs. (click the graph to see how many.)

If the recession isn’t a bad one, and it’s usually not, this problem can be fixed by the Federal Reserve. They just lower the interest rate, and businesses or people that want to build a new home, say—Hey, that’s such a great deal, I can’t pass it up. So they borrow and spend, and the economy starts to recover, and then people get more optimistic and it takes off.

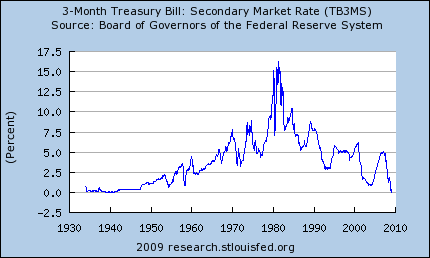

That’s all great, except in a really bad recession—like right now. The Fed has pushed interest rates as close to zero as it can get them, and people are still saving more than others are borrowing. Everyone is just too pessimistic to borrow and spend. So the economy is slowly running down. It’s losing about half a million jobs per month relative to keeping up with labor force growth.

That’s making people more pessimistic. So they feel less like borrowing and spending. We’re in a trap. In the Great Depression we stayed in the trap for about 12 years. We’ve only been in this one a year, but that’s hurt an awful lot of people. Even in the Depression the economy never pulled itself out. It was the enormous deficit spending for World War II that got us out. Take a look.

So the only way we know to get out is for the U.S. government to borrow the money that you and I are saving and spend it for us. If they spend it fast enough, it will create enough jobs to turn this economy around.

A Texas Analogy for Fixing the Financial Crisis

Basics of Depression Economics

By Steven Stoft, March 12, 2009

The housing-bubble burst, banks and the stock market have collapsed, but a new economic danger has now taken control. Consumers have cut spending like a no time since the Great Depression. Worse yet, they’ve got excellent reasons to spend less, and that’s not about to change.

People aren’t buying, so business isn’t selling, so employees are getting laid off—by the millions. At this rate we could be at 10 percent unemployment by early June. That’s getting close to depression territory. The Great Depression was horrible and went on for 12 years. We can’t let this happen again.

But do we know what to do? Amazingly, we do. Banking is complicated, but lack of demand (buying) is pretty simple. The solution was figured out in the depression and applied from 1940 to 1944. And it worked like you would not believe.

The GDP grew 75% in those four years. Five times faster than under Reagan-Bush, three times faster than under Clinton. Never before nor since has the U.S. economy grown this fast, and I don’t think any other economy has either. Starting from the Great Depression, the U.S. build the mighty industrial machine that won World War II.

So what was the trick? Enormous, wasteful government spending.

In those four years, the government borrowed and spend the equivalent of $15 trillion in today’s economy. And the spending was for economically useless battleships and bombs. These do not make our economy one tiny bit more productive. Economically, no spending is more wasteful.

Now I’m not suggesting, useless spending is a good idea. We should spend as wisely as possible. But spending itself is what works in a depression. Other times we should pay down the debt—like Clinton did and Bush did not. And always we should spend wisely.

Why does deficit spending work even if it’s wasteful? In bad times, when jobs are lost, savings in homes and stocks is lost, people spend less. And they should. For there own good, they must. But this hurts local stores, local repair men and construction workers, and national industries like autos and computers.

The situation is simple: Individuals must and should spend less, but this is terrible for businesses and their employees. We cannot ask individuals to spend what they can’t afford or do not have. To get us out of this trap, we must ask our government to do what we cannot do ourselves. This is why we have a government.

The great danger

“It’s time for government to tighten their belts and show the American people that we ‘get’ it.” (CBS  ) House Republican Leader John Boehner, March 8, 2009.

) House Republican Leader John Boehner, March 8, 2009.

Boehner is saying, the government should cut back on spending just like we are forced to. But if the government spends less that means it lays people off and buys few goods from private companies, so these companies will lay people off. In a recession, this is just insane.

This is also the same conservative ideology that kept us in the great depression for 12 years. It restrained Roosevelt who did too little and only got us half way out until World War II. This thinking also influenced Roosevelt and made him more timid.

The craziest part of Boehner’s view is that accepting it would destroy capitalism, while Keynes, Roosevelt, and their modern equivalents A Survival Plan for Capitalism  , are trying to save capitalism.

, are trying to save capitalism.

So fight for wiser spending and more accountability. But please don’t buy the crazy idea, that if we all spend less, including the government, that’s good for business.

Notice that the short-term interest rate is back to where it was in 1941 just before the Great Depression (GD) ended.

That’s why we need depression economics. There are two ways to stimulate an economy (1) monetary policy (lower interest rates), and (2) fiscal policy (government spending). But when the interest rate goes down to zero monetary policy becomes impossible.

That leaves government spending, or we can just stay in GD II for ten years or more. Both are bad choices, but staying in a depression is much worse, so the choice is simple.