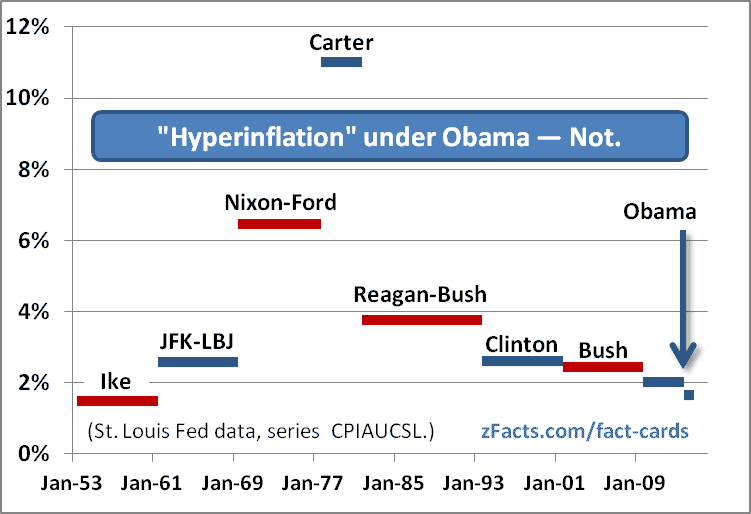

But What About Hyperinflation? Yikes!!!

Oct 24, 2014. Hyperinflation has been a popular conservative theme since 2008, but really, can you get any sillier? Trillions of dollars ago, at the start of the recession (Jan. 2008), inflation was about 2.4%. Now (Oct. 2014), in the last year, it’s averaged under 2%. Hyperinflation? No, just hyperventilating.

Hyperinflation, according to the business dictionary is a “ruinously high increase (50 percent or more per month) in prices.” The case the scare-mongers always cite is Germany between August 1922 and November 1923 — in the German Weimar Republic. Then, the inflation rate reached 322% per month. But, due to compounding, even 50% per month is over 12,000% per year (that’s a 120 times price increase). So to think that the US in in danger of jumping from 2% to 12,000% is sheer lunacy. Such folks can be safely ignored on all topics.

You don’t need to be an economist to figure this out why we’re not having inflation. Say you manage a local restaurant, and you read about the deficit. So you think OMG inflation! I better raise the price of a steak and fries. So you “explain” this to the owner, who says, What have you been smokin’. Business is down from the recession; our competition is having more specials, and you think our customers will pay more because the national debt went up?!

No, believe me. Any business that raises prices because of the national debt, died a long time ago. A booming economy lets them raise price. A recession—yes that’s what’s going on—makes it hard to sell things, so prices get cut. That’s why inflation is down. But, what I can’t figure (can you?) is why people stay so mixed up?

What Drives Inflation?

November 7, 2009. The Federal Reserve has promised not to reignite inflation, but what about the debt? Could that cause inflation anyway?

It’s true, the money supply controls the price level in the long run, but it does not do so directly. No one raises any price because they heard the money supply was up. Inflation is only caused by tight markets — both labor and commodities.

(Oil price increases cause a 1-time price increase not inflation, unless the oil price keeps going up forever.)

So will the market get too tight? Not until the unemployment rate gets back down to about 4.5 to 5%. And then? Then the fed will decide how tight they want it. They might try to devalue the debt with inflation.

What the Fed Says about Inflation

May 5, 2009. BERKELEY, Calif. (Dow Jones)–The end of the recession is in sight, although the recovery could prove long and slow, the San Francisco Federal Reserve Bank’s top official said Tuesday. …

Yellen said she’s more concerned about lower inflation and deflation, than about runaway inflation when the economy recovers. She said she expects inflation to fall below last year’s 2% level, to as low as 1.5% in 2009 and possibly lower in 2010.

“If deflation were to occur with the funds rate near zero, the effects could be severe,” Yellen said. But she added that she doesn’t expect a “deflation problem.”

Meanwhile, Yellen discounted fears that inflation could accelerate once the credit markets ease and the economy picks up steam. The Federal Reserve “is well aware” of the need to tighten its stance on monetary policy when the economy recovers and “is readying the tools even now,” she said.

The prevailing fear is that overly weak economic activity will lead to deflation, but some worry the Fed’s extraordinary interventions could fuel a future inflation boom.

A potential tool the Fed could use to tighten monetary policy while also supporting financial markets would be to issue interest-bearing debt broadly to private investors, Yellen said. Such debt issuances would have to be authorized by Congress, but it’s a common tool used by other central banks, she said.

Yellen noted that the Fed’s efforts to ease financial conditions and lower interest rates appeared to be working, and that positive effects from the billions of dollars in federal aid included in the stimulus package will likely be felt this quarter.